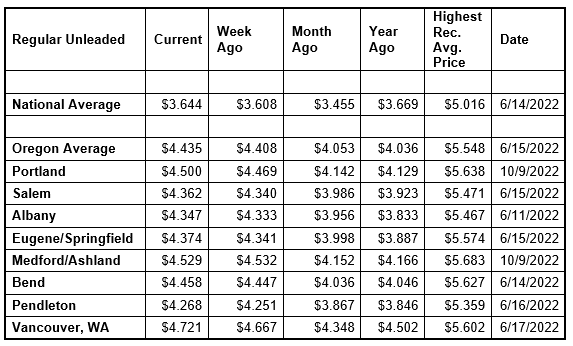

The drone and missile attack by Iran against Israel over the weekend has escalated fears of a wider conflict in the Middle East and has kept crude oil prices above $85 per barrel. These tensions as well as seasonal factors such as refinery maintenance continue to send pump prices higher in Oregon and most other states; however increases are mostly smaller than in previous weeks. This week, the national average for regular gains three cents to $3.64. The Oregon average also adds three cents to $4.44 a gallon. This is the 39th-largest weekly jump for a state in the nation.

“Since many of the Iranian missiles and drones missed their targets and a response from Israel is expected to be limited, fears of a wider conflict have eased for now. However, tensions could easily increase depending on what happens next,” says Marie Dodds, public affairs director for AAA Oregon/Idaho. “Meanwhile, the East Coast is making the switch to summer-blend fuel, which will likely push the national average higher.”

The national and Oregon averages are at their highest prices since October. This week no Oregon counties have averages below $4 a gallon.

The Oregon average began 2024 at $3.79 a gallon compared to $4.44 today. Its lowest price so far this year is $3.58 on February 14 and it has been steadily climbing since then. The national average started the year at $3.11 and is at $3.64 today. Its lowest price so far this year is just under $3.07 on January 15.

Gas prices always rise this time of year as refineries undergo maintenance as the switch to summer-blend fuel occurs. The switch occurs first in California, which is why pump prices on the West Coast often rise before other parts of the country. The East Coast is switching now and is the last major market to make the change to summer-blend fuel. Most areas have a May 1 compliance date for refiners and terminals, while most gas stations have a June 1 deadline to switch to selling summer-blend until June 1. Switch-over dates are earlier in California with some areas in the state requiring summer-blend fuel by April 1. Some refineries will begin maintenance and the switchover as early as February.

Crude oil prices have remained elevated due to geopolitical events around the world including increased volatility in the Middle East, drone attacks on Russian refineries, and Houthi militant attacks in the Red Sea. In addition, production cuts by OPEC+ have tightened global crude oil supplies.

Crude oil prices are at their highest since October. West Texas Intermediate climbed above $80 on March 14 and above $85 on April 2. A major driver is the Ukrainian attacks on Russian refineries. Russia is a top global oil producer and the refinery attacks have reduced output.

Crude prices were volatile after the attack on Israel by Hamas in October. While Israel and the Palestinian territory are not oil producers, there’ve been concerns that the conflict could spread in the Middle East, which could potentially impact crude production in other oil-producing nations in the region.

Crude oil is trading around $85 today compared to $85 a week ago and $81 a year ago. In 2023, West Texas Intermediate ranged between $63 and $95 per barrel. Crude reached recent highs of $123.70 on March 8, 2022, shortly after the Russian invasion of Ukraine, and $122.11 per barrel on June 8, 2022. The all-time high for WTI crude oil is $147.27 in July 2008.

Crude oil is the main ingredient in gasoline and diesel, so pump prices are impacted by crude prices on the global markets. On average, about 57% of what we pay for in a gallon of gasoline is for the price of crude oil, 14% is refining, 13% distribution and marketing, and 16% are taxes, according to the U.S. Energy Information Administration.

Demand for gas in the U.S. fell from 9.24 million b/d to 8.61 million b/d for the week ending April 5, according to the U.S. Energy Information Administration (EIA). This compares to 8.94 million b/d at the same time last year. Gasoline sales rose in the week preceding Easter, then fell the following week.

Meanwhile, total domestic gasoline stocks increased by 700,000 bbl to 228.5 million bbl.

Lower demand and an increase in stocks can put downward pressure on pump prices; however, elevated crude oil prices will likely send pump prices higher.

Quick stats

Oregon is one of 40 states and the District of Columbia with higher prices now than a week ago. Michigan (+14 cents) has the largest week-over-week gain in the nation. Oregon has the 39th-largest increase. Indiana (-11 cents) has the biggest weekly decline.

California ($5.46) has the most expensive gas in the nation for the seventh week in a row and is the only state in the nation with an average at or above $5 per gallon. Hawaii ($4.77) is second, Washington ($4.674) is third, Nevada ($4.65) is fourth, Oregon ($4.44) is fifth, Alaska ($4.37) is sixth, and Arizona ($4.13) is seventh. These are the seven states with averages at or above $4, same as a week ago. This week 43 states and the District of Columbia have averages in the $3-range. No states have averages in the $2 range this week.

The cheapest gas in the nation is in Colorado ($3.06) and Mississippi ($3.10). No state has had an average below $2 a gallon since January 7, 2021, when Mississippi and Texas were below that threshold.

The difference between the most expensive and least expensive states is $2.40 this week, compared to $2.31 a week ago.

Oregon is one of 49 states and the District of Columbia with higher prices now than a month ago. The national average is 19 cents more and the Oregon average is 38 cents more than a month ago. This is the seventh-largest monthly gain in the nation. Utah (+58 cents) has the largest monthly jump. Colorado (-2/10ths of a cent) is the only state with a month-over-month decline.

Oregon is one of 14 states with higher prices now than a year ago. The national average is three cents more and the Oregon average is 40 cents more than a year ago. This is the third-largest yearly gain in the nation. California (+54 cents) has the largest year-over-year increase. Colorado (-52 cents) has the largest yearly decrease.