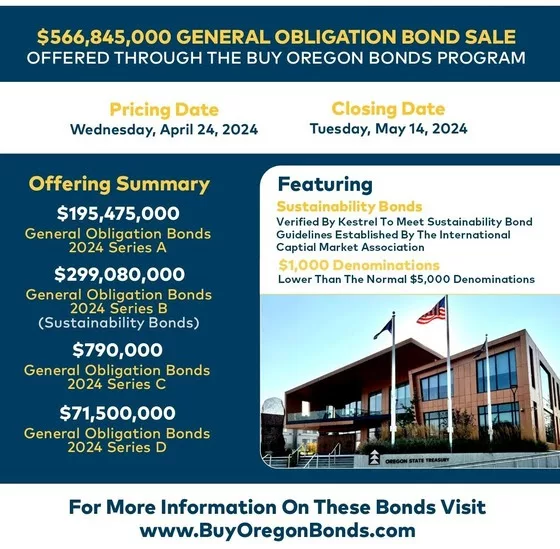

Oregon State Treasury is excited to announce an upcoming $566.8 million General Obligation (GO) Bond offering through its Buy Oregon Bonds Program. The April 24 sale, which features $1,000 denomination offerings, will provide funding for affordable housing programs and capital improvement projects across state government. The upcoming offering includes more than $299 million third-party verified Sustainability Bonds, which will finance the development of affordable, energy-efficient housing in Oregon.

“As we prepare to launch this offering, we recognize the profound long-term benefits this funding will provide Oregonians. The Buy Oregon Bonds Program promotes the wise use of state debt to build key infrastructure and provide critical funding that will support communities across Oregon,” said State Treasurer Tobias Read. “The use of Sustainability bonds is central to this bond sale and will align these investments with Oregon’s environmental commitments.”

The Sustainability Bonds will support the State’s Permanent Supportive Housing and Local Innovation and Fast Track Housing Programs. Kestrel, an approved verifier accredited by the Climate Bonds Initiative, awarded the accreditation following an independent external review, in which they determined the projects and associated Series B Bonds would address housing needs in Oregon, meet green building requirements, and advance Oregon’s goal of reducing statewide energy consumption and greenhouse gas emissions. These factors helped the bonds meet the Sustainability Bond Guidelines established by the International Captial Market Association. This is the first time Oregon has achieved this third-party designation, which will help attract a wider range of investors to the upcoming bond sale.

The Buy Oregon Bonds Program will offer Oregonians an opportunity to invest in their state through the bond sale’s $1,000 denomination offering, lower than the normal $5,000 denominations. Treasury began offering the lower denomination in 2023, resulting in historically high local retail investor participation.

Oregon’s strong economic position and Treasury’s attention to debt and budget discipline has allowed the state’s credit ratings to remain steady and solid, yielding favorable interest rates despite a market environment in flux. As a result, the State of Oregon saves millions of dollars in interest costs over time, keeping more money for programs and resources in the State’s general fund.

For more information about the Buy Oregon Bonds Program and upcoming bond offerings visit: www.oregon.gov/treasury/oregon-bonds/buy-oregon-bonds

About Treasury

The Oregon State Treasury advances the financial wellbeing of all Oregonians. We provide low-cost banking, debt management, and investment programs for governments and empower Oregonians to invest in themselves and their loved ones through the Oregon College Savings Plan, Oregon ABLE Savings Plan, and OregonSaves. Treasury also facilitates the state’s Unclaimed Property Program.